Loan Default Project

Business Objective

A bank has given us a data set and would like us to find which potential customers will likely repay a bank loan and what questions to ask on future applications based off of previous loan data.

- Data set of Loans and if they were paid or defaulted.

- Look for the Customers who have paid and predict if future customers will pay back or default loan.

- Come up with questions for customer when they are applying for loan

import pandas as pd

df = pd.read_csv('1533148983_LoansTrainingSet.csv')

Taking a Look at the Data

df.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 256984 entries, 0 to 256983

Data columns (total 19 columns):

Loan ID 256984 non-null object

Customer ID 256984 non-null object

Loan Status 256984 non-null object

Current Loan Amount 256984 non-null int64

Term 256984 non-null object

Credit Score 195308 non-null float64

Years in current job 245508 non-null object

Home Ownership 256984 non-null object

Annual Income 195308 non-null float64

Purpose 256984 non-null object

Monthly Debt 256984 non-null object

Years of Credit History 256984 non-null float64

Months since last delinquent 116601 non-null float64

Number of Open Accounts 256984 non-null int64

Number of Credit Problems 256984 non-null int64

Current Credit Balance 256984 non-null int64

Maximum Open Credit 256984 non-null object

Bankruptcies 256455 non-null float64

Tax Liens 256961 non-null float64

dtypes: float64(6), int64(4), object(9)

memory usage: 37.3+ MB

df.head()

| Loan ID | Customer ID | Loan Status | Current Loan Amount | Term | Credit Score | Years in current job | Home Ownership | Annual Income | Purpose | Monthly Debt | Years of Credit History | Months since last delinquent | Number of Open Accounts | Number of Credit Problems | Current Credit Balance | Maximum Open Credit | Bankruptcies | Tax Liens | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 000025bb-5694-4cff-b17d-192b1a98ba44 | 5ebc8bb1-5eb9-4404-b11b-a6eebc401a19 | Fully Paid | 11520 | Short Term | 741.0 | 10+ years | Home Mortgage | 33694.0 | Debt Consolidation | $584.03 | 12.3 | 41.0 | 10 | 0 | 6760 | 16056 | 0.0 | 0.0 |

| 1 | 00002c49-3a29-4bd4-8f67-c8f8fbc1048c | 927b388d-2e01-423f-a8dc-f7e42d668f46 | Fully Paid | 3441 | Short Term | 734.0 | 4 years | Home Mortgage | 42269.0 | other | $1,106.04 | 26.3 | NaN | 17 | 0 | 6262 | 19149 | 0.0 | 0.0 |

| 2 | 00002d89-27f3-409b-aa76-90834f359a65 | defce609-c631-447d-aad6-1270615e89c4 | Fully Paid | 21029 | Short Term | 747.0 | 10+ years | Home Mortgage | 90126.0 | Debt Consolidation | $1,321.85 | 28.8 | NaN | 5 | 0 | 20967 | 28335 | 0.0 | 0.0 |

| 3 | 00005222-b4d8-45a4-ad8c-186057e24233 | 070bcecb-aae7-4485-a26a-e0403e7bb6c5 | Fully Paid | 18743 | Short Term | 747.0 | 10+ years | Own Home | 38072.0 | Debt Consolidation | $751.92 | 26.2 | NaN | 9 | 0 | 22529 | 43915 | 0.0 | 0.0 |

| 4 | 0000757f-a121-41ed-b17b-162e76647c1f | dde79588-12f0-4811-bab0-e2b07f633fcd | Fully Paid | 11731 | Short Term | 746.0 | 4 years | Rent | 50025.0 | Debt Consolidation | $355.18 | 11.5 | NaN | 12 | 0 | 17391 | 37081 | 0.0 | 0.0 |

Going through each column, duplicate values have been recorded, missing information needs to be filled in multiple columns and object columns need to be convereted to numbers. Also, the ‘credit score’ column has a recording error. The column most important column we need for analysis is ‘Loan Status’. Which is our column that shows if a loan was paid off or defaulted.

# drop exact duplicate rows

df.drop_duplicates(keep='first', inplace=True)

# Split Columns between numbers and objects to groupby 'Loan ID' so we can fill in missing values

df_obj = df.select_dtypes(include='object')

df_num = df.select_dtypes(exclude='object')

# Loan ID to numbers data frame so can use groupby

df_num['Loan ID'] = df['Loan ID']

# groupby Loan ID and takes the max of each loan

df_num = df_num.groupby('Loan ID').max().reset_index()

df_obj = df_obj.drop_duplicates(subset='Loan ID')

df = df_obj.merge(df_num)

# grabbing Loan and Customer ID

loan_cust_id = df[['Loan ID', 'Customer ID']]

df.drop(['Loan ID', 'Customer ID'], axis=1, inplace=True)

Filling in Missing Data

Columns with NaN values were filled with values similar to data in the row

# BANKRUPTCIES

df['Bankruptcies'].fillna(0.0, inplace=True)

df['Tax Liens'].fillna(0.0, inplace=True)

# Months since last delinquent

df['Months since last delinquent'].fillna(0.0, inplace = True)

# Replace Column Years in current job == < 1 Year to .5 integer

df['Years in current job'].replace('< 1 year', 0.5, inplace=True)

# Replace Column Years in current job == 10+ Year to 15 year

df['Years in current job'].replace('10+ years', '15 year', inplace=True)

# Fill NaN Values in Years in current job column to '0 year' string

df['Years in current job'] = df['Years in current job'].fillna(value='0 years')

# Extracts digit from Years in current job and changes Years in current job to int

df['Years in current job'] = df['Years in current job'].str.extract('(\d+)').astype(float)

# Fill NaN Values in Years to 0.5 for < 1 year

df['Years in current job'] = df['Years in current job'].fillna(value=0.5)

CORRECTING DATA INPUT ERRORS

# replace other to Other

df.replace('other', 'Other', inplace=True)

# Changes #VALUE! in Maximum Open Credit to 0

df.loc[df['Maximum Open Credit'] == '#VALUE!', 'Maximum Open Credit'] = df['Current Loan Amount'].median()

# found median of Loan Amount without the 99999999 values

loan_median = df[df['Current Loan Amount'] < 99999999]['Current Loan Amount'].median()

# Change the 9999999 Loan Amount Values to loan median

df.loc[df['Current Loan Amount'] == 99999999, 'Current Loan Amount'] = loan_median

# replace HaveMortgage to Home Mortgage

df.replace('HaveMortgage', 'Home Mortgage', inplace=True)

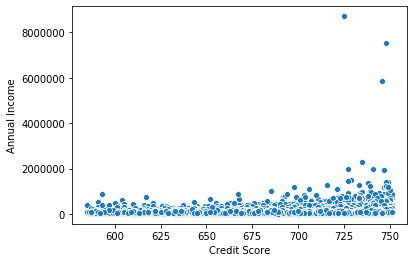

For a score with a range between 300-850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most credit scores fall between 600 and 750

df['Credit Score'].describe()

count 171202.000000

mean 1261.776013

std 1775.229972

min 585.000000

25% 716.000000

50% 735.000000

75% 745.000000

max 7510.000000

Name: Credit Score, dtype: float64

df['Credit Score'] = df['Credit Score'].apply(lambda x : x / 10 if x > 1000 else x)

df['Credit Score'].describe()

count 171202.000000

mean 722.755698

std 26.827283

min 585.000000

25% 712.000000

50% 732.000000

75% 742.000000

max 751.000000

Name: Credit Score, dtype: float64

Changing Object Columns to numeric

Many of the columns have object data types including: Term, Home Ownership, Purpose, Loan Status, Monthly Debt and Maximum Open Credit. Those that will be changed to nonordinal datatype include Term, Home Ownership, Purpose. The other columns will be changed to numerical. Loan Status, which is our target, will be converted to 0 based on being paid off and 1 being unpaid.

d = {'Fully Paid': 0, 'Charged Off': 1}

df['Loan Status'] = df['Loan Status'].map(d)

# removing , and $ from Monthly Debt and changing to float

df['Monthly Debt'] = df['Monthly Debt'].str.replace(',','')

df['Monthly Debt'] = df['Monthly Debt'].str.replace('$','')

df['Monthly Debt'] = df['Monthly Debt'].astype(float)

df['Maximum Open Credit'] = df['Maximum Open Credit'].astype(float)

Creating Dummies for the Columns: Term, Home Ownership and Purpose

df = pd.get_dummies(df, drop_first=True)

loan = df.corr()['Loan Status']

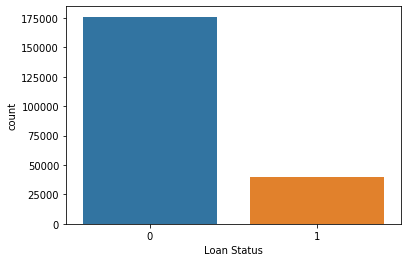

sns.countplot(x='Loan Status', data=df)

sns.scatterplot(x='Credit Score', y='Annual Income', data=df)

# Take out Loan Status and Annual Income to predict them

loan_status = df['Loan Status']

income = df['Annual Income']

df.drop(['Loan Status', 'Annual Income'], axis=1, inplace=True)

from sklearn.linear_model import LinearRegression

from sklearn.model_selection import train_test_split

from sklearn.metrics import r2_score, mean_squared_error

filled = df[df['Credit Score'].notnull()]

missing = df[df['Credit Score'].isnull()]

X_train, X_test, y_train, y_test = train_test_split(filled.drop('Credit Score', axis=1),

filled['Credit Score'], test_size=0.4, random_state=101)

L = LinearRegression()

L.fit(X_train, y_train)

r2_score(y_train, L.predict(X_train))

0.28462988125672517

mean_squared_error(y_train, L.predict(X_train))**.5

22.740334260998736

predict = L.predict(X_test)

predictions = L.predict(missing.drop('Credit Score', axis=1))

missing['Credit Score'] = predictions

df = pd.concat([missing, filled])

# Adding Annual Income Column back

df['Annual Income'] = income

filled = df[df['Annual Income'].notnull()]

missing = df[df['Annual Income'].isnull()]

X_train, X_test, y_train, y_test = train_test_split(filled.drop('Annual Income', axis=1),

filled['Annual Income'], test_size=0.4, random_state=101)

L.fit(X_train, y_train)

print(r2_score(y_test, L.predict(X_test)))

print(mean_squared_error(y_test, L.predict(X_test))**.5)

0.3833735024596715

38215.97609792463

prediction = L.predict(missing.drop('Annual Income', axis=1))

missing['Annual Income'] = prediction

df = pd.concat([missing, filled])

df['Loan Status'] = loan_status

sns.countplot(x='Loan Status', data=df)

Imbalanced Data

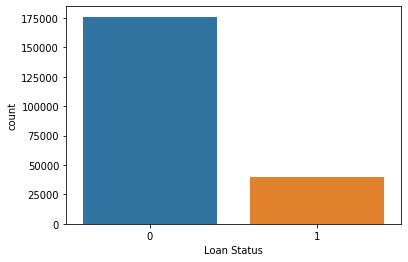

Using undersampling to balance out the number of Loans that were paid off and unpaid. The under sampled ‘Loan Status’ which is the charged off loans will match the number of paid off loans.

# Shuffle the Dataset.

shuffled_df = df.sample(frac=1,random_state=4)

# Put all the charged off loan class in a separate dataset.

upaid_df = shuffled_df.loc[shuffled_df['Loan Status'] == 1]

#Randomly select 492 observations from the paid off (majority class)

paid_df = shuffled_df.loc[shuffled_df['Loan Status'] == 0].sample(n=39509,random_state=42)

# Concatenate both dataframes again

normalized_df = pd.concat([upaid_df, paid_df])

#plot the dataset after the undersampling

plt.figure(figsize=(8, 8))

sns.countplot('Loan Status', data=normalized_df)

plt.title('Balanced Classes')

plt.show()

X = normalized_df.drop('Loan Status', axis=1)

y = normalized_df['Loan Status']

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.4, random_state=101,

stratify=normalized_df['Loan Status'])

from sklearn.linear_model import LogisticRegression

log = LogisticRegression()

log.fit(X_train, y_train)

LogisticRegression(C=1.0, class_weight=None, dual=False, fit_intercept=True,

intercept_scaling=1, l1_ratio=None, max_iter=100,

multi_class='auto', n_jobs=None, penalty='l2',

random_state=None, solver='lbfgs', tol=0.0001, verbose=0,

warm_start=False)

predictions = log.predict(X_test)

from sklearn.metrics import classification_report, confusion_matrix

print(classification_report(y_test, predictions))

precision recall f1-score support

0 0.59 0.60 0.60 15804

1 0.60 0.59 0.59 15804

accuracy 0.59 31608

macro avg 0.59 0.59 0.59 31608

weighted avg 0.59 0.59 0.59 31608

Based off the classification report, we scored about 60% accuracy that people will both pay back their loans and if they will default on their loans.

import numpy as np

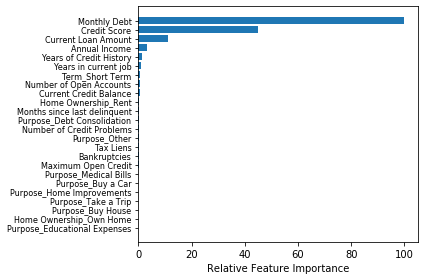

feature_importance = abs(log.coef_[0])

feature_importance = 100.0 * (feature_importance / feature_importance.max())

sorted_idx = np.argsort(feature_importance)

pos = np.arange(sorted_idx.shape[0]) + .5

featfig = plt.figure()

featax = featfig.add_subplot(1, 1, 1)

featax.barh(pos, feature_importance[sorted_idx], align='center')

featax.set_yticks(pos)

featax.set_yticklabels(np.array(X.columns)[sorted_idx], fontsize=8)

featax.set_xlabel('Relative Feature Importance')

plt.tight_layout()

plt.show()

Conclusion

After looking at the chart above which feature importance that is based off of the column coefficients, the most important questions to ask future loan applicants are:

- How much is their monthly debt?

- What is their credit score?

- How much is their current loan amount?

- What is their annual income?